You should not enter the total cost of a package of rolls and a package of hotdogs. Instead, you should enter the cost of an individual roll and a single hotdog. However, it might be too complicated to do the calculation, so you can spare yourself some time and effort by using this Break-even Calculator. All you need to do is provide information about your fixed costs, and your cost and revenue per unit. To make the analysis even more precise, you can input how many units you expect to sell per month.

Net Profit Margin Calculator

- This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy.

- So, after deducting $10.00 from $20.00, the contribution margin comes out to $10.00.

- Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

- The break-even point can be affected by a number of factors, including changes in fixed and variable costs, price, and sales volume.

- Depending on your needs, you may need to calculate your profit margin or markup to find your revenue…

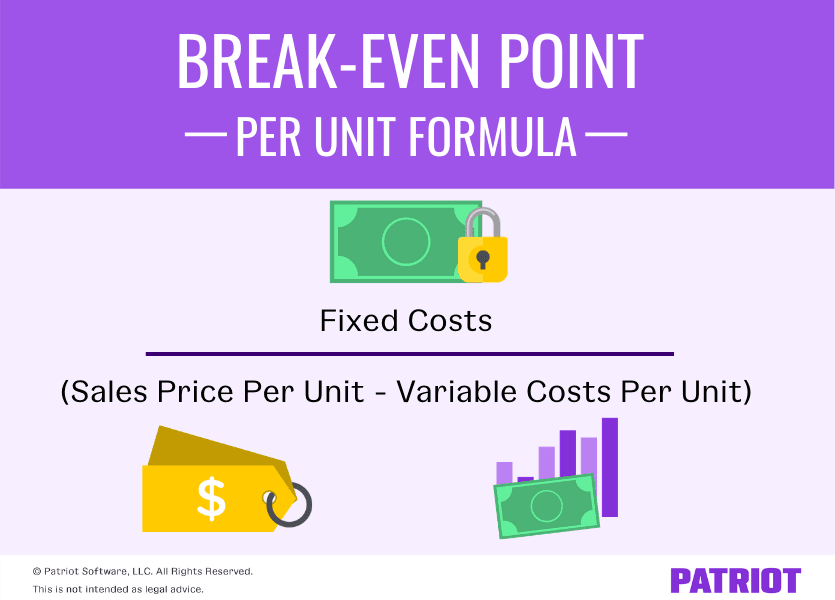

- Just enter your fixed costs, variable costs per unit, and sale price per unit.

All of our content is based on objective analysis, and the opinions are our own. Using the algebraic method, we can also identify the break-even point in unit or dollar terms, as illustrated below. The only national organization that pro-actively helps you grow your business and your bottom line. The point being is, what the break-even point analysis means depends on how you entered the numbers.

Get Started with Our Break-Even Point Calculator

Simply enter your fixed and variable costs, the selling price per unit and the number of units expected to be sold. When you outsource fixed costs, these costs are turned into variable costs. Variable costs are incurred only when a sale is made, meaning you only pay for what you need. 3 steps to create a hiring process to identify the best candidates Outsourcing these nonessential costs will lower your profit margin and require you to sell fewer products to make a profit. Launching a new product or service can be exciting but equally intimidating, especially when you’re unsure how much you’ll need to sell to cover your costs.

Using break-even analysis to determine level of production

Here are four ways businesses can benefit from break-even analysis. Break-even analysis, also known as break-even point analysis, involves calculating the point at which a business breaks even and what steps it might take to become profitable. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. No, the break-even point cannot be used to predict future profits. It is only useful for determining whether a company is making a profit or not at a given point in time. This section provides an overview of the methods that can be applied to calculate the break-even point. Notice how the calculator automatically calculates the cumulative cost total. The BEP is the number of units that you must sell for a deal or business to break-even.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

If the company can increase its contribution margin per unit to $8 (by perhaps lowering its per unit variable cost), it only needs to sell 8,750 ($70,000 / $8) to break even. Break-even analysis compares income from sales to the fixed costs of doing business. The five components of break-even analysis are fixed costs, variable costs, revenue, contribution margin, and break-even point (BEP). Given your profit margin, it is important to know how many units of a certain product that you will need to sell in order to cover your fixed/startup costs.

He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

Break-even analysis assumes that the fixed and variable costs remain constant over time. However, costs may change due to factors such as inflation, changes in technology, and changes in market conditions. It also assumes that there is a linear relationship between costs and production. Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences. Whether you’re trying to promote your brand-new product, stay ahead of your competitors, or cut down on your expenses, you need to have a strategy in place. This helps you craft a more formidable strategy and reap better benefits for your company.

Conversely, it can also help you determine how many costs you need to cut to reach profitability. Out of the several ways to measure your business’s profitability, calculating the break-even point is one of the most simplistic. It’s also important to keep in mind that all of these models reflect non-cash expense like depreciation.